ETI Increases as a COVID-19 Relief Measure

As part of the government’s COVID-19 relief measures, the ETI claimable by employers has been increased for the pay period 1 April – 31 July 2020. The SimplePay team have been hard at work implementing these changes and are happy to announce that it is now live on the system.

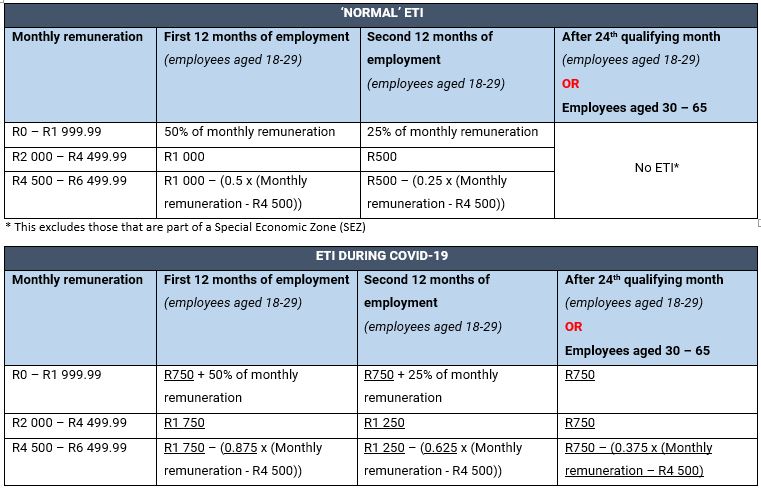

If you, as the employer, meet the qualifying criteria, have enabled ETI for qualifying employees and have enabled the additional COVID-19 ETI settings, then the following ETI rules will supersede the normal rules for ETI calculations for the pay period 1 April 2020 – 31 July 2020 only. The differences between the two are underlined.

Please note that the default minimum wage for ETI is R2 000. However, the R0 – R1 999.99 bracket is available for those industries and SEZ’s with a lower minimum wage agreed upon with SARS.

For more information on qualifying criteria, qualifying employees and enabling ETI settings, visit our Additional ETI (COVID-19) help page.

Team SimplePay