New Feature: UIF, SDL and Retirement Deduction Traces

In our blog post on 5 June, we announced a new ETI trace, which shows the ETI calculation for each employee. Today, we are happy to announce that we have also created traces for the UIF, SDL and Retirement Deduction calculations.

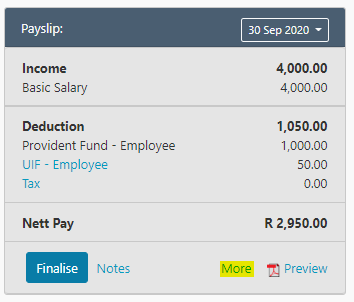

To view these traces, go to an employee’s profile, click on More next to Preview to open the web view of the payslip that you are on.

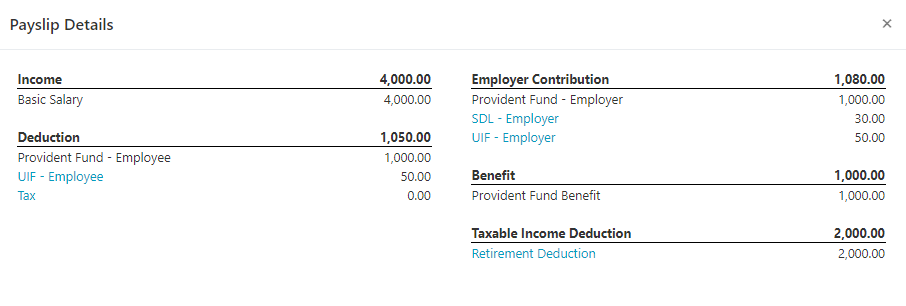

Click on any of the following to open the trace for that payslip item:

- UIF – employee (new)

- UIF – employer (new)

- SDL – employer* (new)

- Retirement deduction (new)

- Tax (existing)

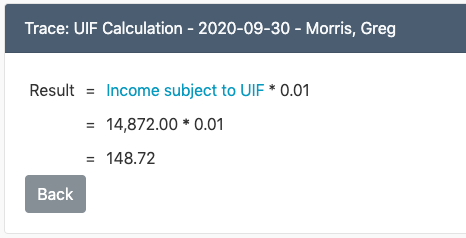

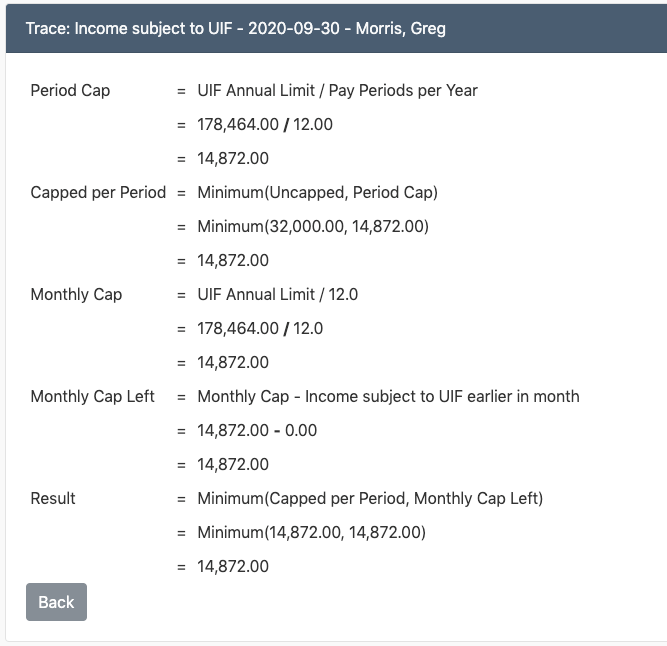

When you open the UIF trace, you will then be able to click on Income Subject to UIF to view how the income used in the UIF calculation was determined.

Similarly, when you open the SDL trace, you will be able to click on Income Subject to SDL.

*Reminder: the government has provided an SDL holiday until the end of August. The SDL trace will therefore only be available for payslips after August.

We hope these new features help you to answer some of the questions that you may have on how these payslip items are calculated, so that you can more easily check your payroll and also answer questions that employees may have.

If you need any assistance with these new features, please reach out to our support team.

Team SimplePay